Message from the CEO: Here to Help

Dear Members,

In these uncertain times, the Treasury function is as important as ever to every Australian business. If you have been impacted in your role by the current pandemic, we want to help.

Just as individuals have been impacted, so too have many Treasuries been impacted with extra responsibility and are as such resource poor. The FTA would like to bring together prospective employees and employers to match up capabilities and needs on both sides.

So if your team needs an extra set of hands to help with the day to day; or if you are looking for work, contact the FTA, Australia’s Treasury Community.

Do not hesitate to contact us at comms@financetreasury.com.au

Regards

Ben Leaver

Chief Executive Officer

Finance and Treasury Association

Message from the CEO: COVID-19

Dear Members,

I’m writing to update you on the FTA response to the growing COVID-19 threat. Given the amount of information you are already receiving, I will keep this brief.

From a resource perspective, we are very small, but we are now working separately to each other, while maintaining member servicing. While this is important for the well being of the team, it is vital that we play our part in restricting the spread of the virus through our communities, and therefore to those most vulnerable people. This is something we feel very strongly about and believe everyone should be undertaking where possible.

For our members and Treasury community, we are working hard to ensure ongoing value and a continuing viable business. To that end we are

- Not holding any face to face meetings or functions from March 16 until May 31 unless advised by authorities that it has become safe to do so. We will further advise any addition to this.

- Working hard on delivering an increased online CPD program via increased numbers of webinars and content sharing

- Exploring ways to deliver other educational programs in a virtual or online environment

- Finalising improvements to our website including a communications forum to facilitate online networking and discussion

On behalf of the Board, I thank you all for your ongoing support, and while we consider these steps to be the only option for our wider community, we do apologise for any disruption this may cause.

If you have any questions, do not hesitate to contact us at comms@financetreasury.com.au

Stay safe, take care of each other – we look forward to resuming normal programs as soon as possible.

Regards

Ben Leaver

Chief Executive Officer

Finance and Treasury Association

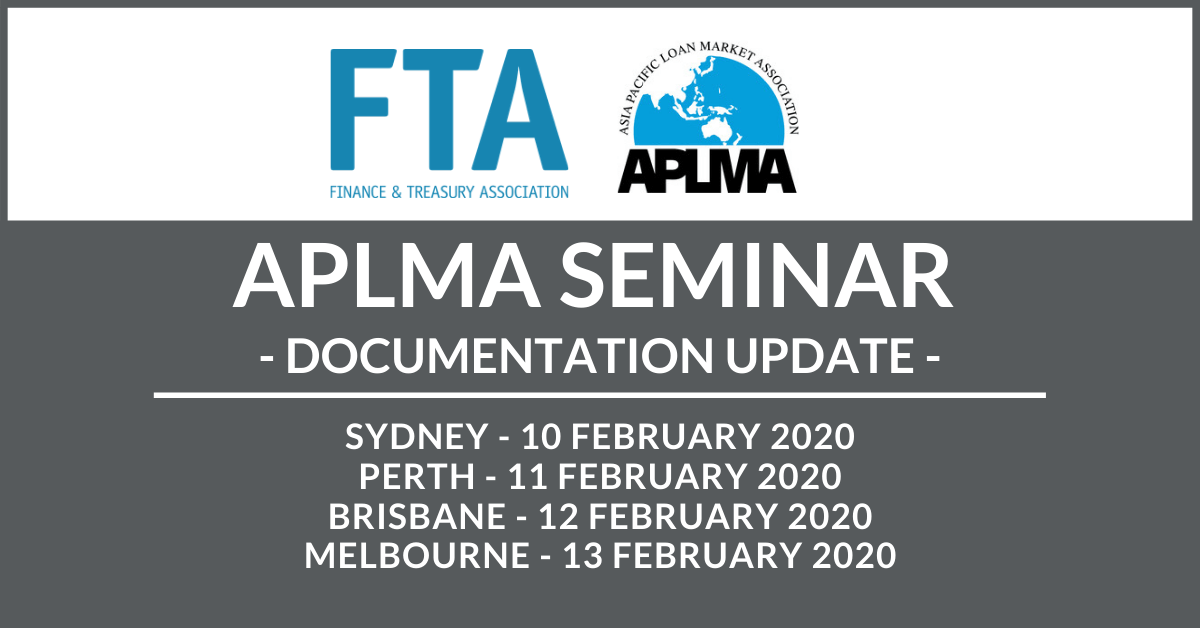

APLMA SEMINAR – 2020 DOCUMENTATION UPDATE

APLMA SEMINAR – 2020 DOCUMENTATION UPDATE

The Finance and Treasury Association invites you to join us as APLMA provide a general update and takle the following APLMA documentary issues arising out of recent market developments:

- Green Finance

This will include a review of the green loan principles published by the APLMA in support of environmentally sustainable economic activity.

- Competition law issues for syndicated loans

This will include a review of ‘cartel provisions’ and exceptions, and an analysis of key risks during the syndication process.

- IBOR Reform

This will include a summary of developments leading to the removal of the LIBOR benchmark rate and the rate mechanisms that may be used in future.

Dates and Locations:

Register here: SYDNEY – 10 FEBRUARY 2020

KWM – Sydney – Level 61, Governor Phillip Tower, 1 Farrer Place, Sydney NSW 2000

![]()

Register here: PERTH – 11 FEBRUARY 2020

KWM – Perth – 30/250 St Georges Terrace, Perth WA 6000

![]()

Register here: BRISBANE – 12 FEBRUARY 2020

Allens – Brisbane – 26/480 Queen St, Brisbane City QLD 4000

Register here: MELBOURNE – 13 FEBRUARY 2020

Allens – Melbourne – 37/101 Collins St, Melbourne VIC 3000

Thank you to our hosts

- King & Wood Mallesons

- Allens

Time:

All Seminars commence at 12:00pm (local time) and will conclude at 2:00pm

Essential Treasurer Series 2020

Essential Treasurer Series 2020

The Finance and Treasury Association together with EY, will again present the Essential Treasurer Series for 2020.

The Essential Treasurer Series is the FTA’s annual session to update its members and other interested parties in what is important and topical right now.

The Essential Treasurer Series will take place in Sydney, Brisbane, Perth, and Melbourne and with speakers from Greensill, Bloomberg, and EY discussing:

- Key market information

- Technology – automation, TMS implementation, NPP/Payments

- Benchmark rates – practical to do’s, regulation, options

- Preparing for a zero interest rate environment

- Innovative alternative funding solutions

Register now to ensure your place – networking drinks will follow the program.

Dates and Locations:

The Series will be hosted at EY in each respective city.

Sydney – Tuesday 3rd March 2020

Brisbane – Tuesday 10th March 2020

Perth – Thursday 12th March 2020

Melbourne – Monday 16th March 2020

Time:

Essential Treasurer Series: 2:00pm – 6:00pm (local time)

Networking Drinks: 6:00pm – 7:30pm (local time)

Cost:

FTA Members have access for free to the Essential Treasurer Series.

Non-Members can access the Series for a fee of $50 (inc GST).

Full-Time Students interested in Treasury can access the Series for a fee of $20 (inc GST)

FTA Conference 2018 speaker presentations

The following presentations were made at the recent FTA Conference on 14 – 16 November 2018.

Day 1: Thursday 15 November 2018

Keynote Speaker: Penelope Twemlow, CEO, Energy Skills Queensland

“Rethinking the leadership role of the Treasury Function – opportunities for the future and beyond”

| 11.50 am- 1 pm | Stream 1: The Strategic Treasurer | Stream 2: Global Economic Environment |

| Strategic-treasurer-PwC | Global-economic-environment-CBA | |

| Strategic-treasurer-Lendlease | Global-economic-environment-NSW-TCorp | |

| Strategic-treasurer-Caltex (002) | ||

| 2.00 – 3.30 pm | Stream 1: Different Types of Treasury Approaches | Stream 2: The Capital Stack |

| Different-types-of-treasury-approaches-Metcash | The-capital-stack-AMP | |

| Different-types-of-treasury-approaches-CPB | The-capital-stack-CBA | |

| The-capital-stack-FitchRatings | ||

| 4.00 – 5.30pm | Stream 1: Cash Management | Stream 2: Diversity in Treasury – Leading the Way |

| Cash-management-Chelsea-McGregor | ||

| Cash-management-Pepper-Financial |

Day 2: Friday 16 November 2018

| 9.10 – 10.00 am | Stream 1: Treasury Technology | Stream 2: Risk Management – High-speed panel discussion on managing risk |

| Risk-management-panel-discussion | ||

| 10.00 – 10.55 am | Stream 1: Fintech, Big Data, Crypto-Technologies | Stream 2: Accounting AASB16 |

| Crypto-tech-TravelByBit | Accounting-AASB16-Deloitte | |

| Disruption-SP-Global | Accounting-AASB16-SP-Global | |

| Blockchain-CBA | Accounting-AASB16-Metcash | |

| 11.20 am- 12.35pm | Stream 1: Back To the Future – Hedging in 2030 | Stream 2: Networking – Why? |

| Networking-why |

Special Interest Group (SIG) for Bank Treasurers 11.00am – 1.15pm

This was an invite-only event led by Steven Cunico FFTP, Partner, Deloitte & FTA Board Member.