Anyone who’s being reading the financial press knows that LIBOR is on the nose. Billions of dollars in fines, sanctions, regulatory action and even jail time have ensured LIBOR has a limited life. While the Financial Conduct Authority in the UK requires banks to contribute to USD, CHF, EUR & JPY LIBOR until 2021, they have made it clear they will not require banks to contribute beyond that date and they want a fallback agreed and ready to take its place.

For the major currencies alternative reference rate committees have agreed fallbacks. Sterling Overnight Rate (SONIA) has been selected as the appropriate rate to replace GBP LIBOR. and the US Secured Overnight Financing Rate (SOFR) will replace USD LIBOR[1]. In Australia, AONIA has been selected as the appropriate fallback.[2] While this has been going on in the background Corporate Treasurers in Australia will have some questions:

Q1: What’s the fuss about?

Most loan contracts, derivatives documentation and other contracts don’t contemplate cessation of benchmark reference rates. Some contracts allowed for short term disturbances to a benchmark, but not the benchmark ceasing. Some require the last determined benchmark to be used, while others may cease to function if there is no benchmark. So there is a massive logistical exercise to resolve the documentation issues, before the fallback is actually agreed. While a consensus is forming around the fallback rates, there are still many issues to resolve before a final agreement is in place. Even when the fallback is agreed, consideration must be given to what situation will result in the fallback being invoked. These must be carefully defined.

The work required is substantial, and time is limited: 2021 is just around the corner.

Let’s not forget the impact is not solely on contracts and derivatives. Changes will be required to hedge accounting rules to allow for the changes and the International Accounting Standards Board (IASB) is providing guidance. It is not clear how far any relief will go. There may also be tax effects from changes in value in the move from current benchmark to the fallback. Again, these are unknowns.

Q2: Why would it affect me?

The introduction was focussed on LIBOR, but this change impacts every interest rate benchmark. There are IBORs for a number of other currencies, such as EUR EURIBOR, HKD HIBOR, AUD BBSW and NZD BKBM. Each one of these benchmarks requires a fallback.

All Corporates will have loan agreements, derivative contracts and commercial documentation which references one or more of these rates. These documents require amending prior to 2021 to avoid confusion about how to apply the benchmark or in extreme circumstances the validity of the contract.

While corporate borrowers in Australia might be comforted by statements from the ASX and others confirming BBSW is fairly robust and it is based on real transactions, there are particular concerns for 1 month BBSW which is seeing reduced trading liquidity.

Anyone with foreign currency borrowing programs together that use cross currency swaps may be exposed to IBOR fall backs either on the transaction itself or the curves used to value these trades.

Q3: What do I need to do?

Your first step is to establish all the contracts, loans, derivatives and other documentation which reference LIBOR, BBSW or any of the other benchmarks. Don’t just assume it is only in loan and derivative documentation: benchmarks can appear almost anywhere.

Once you’ve found all the relevant contracts, you will need to contact all parties to renegotiate the documents. For derivatives, it is expected ISDA will organise a protocol for counterparties to adhere to, but other contracts will likely require individual renegotiation.

Then you’ll need to ensure your treasury and accounting systems can cope with a cash benchmark which is potentially calculated daily and compounded in arrears. This will be different to the current benchmarks which are set at the start of the interest period and paid at the end. For 1 day cash rate referencing transactions, the final cash flow is based on observations across the accrual period, and therefore only known just before payment. This is a massive change to current practice and is not something corporates are used to with borrowings and derivatives (it is more akin to overdraft interest costs).

At this stage there are no alternative reference rates that have tenors similar to exiting IBOR’s, although this would simplify the migration away from IBORs.

Q4: Isn’t this just a bank problem

This is certainly a bank problem, but also problem for everyone in the market. While banks will have the majority share of derivative and loan contracts, they also currently manage cash to short term borrowing risks and are able to work with cash rates which compound daily in arrears. Banks could probably survive without term alternative reference rates, but it is not so simple for corporate borrowers.

All counterparties need to be working on amending documentation and ensuring they are ready for 2021.

Q5: Can my bank help me?

Yes, to a certain extent your Bank can help you deal with the changes. There are, however, contracts your bank are not party to, and you need to manage the adjustment. In addition, your systems may require changes to accommodate the cash rate fallback – this is not something you can expect your bank to deal with.

Q6: How bad could it be?

With no fallback language in your contracts, in extreme cases they may cease to function. If you have the right language in your contracts but, your systems can’t handle the cash rate fallback, you may struggle to reflect the transactions in your accounting systems. If you are trying to deal with this issue after the fallback has been invoked, you will struggle to deal with the impacts. This is something which needs addressing now.

Q7: Can’t I just borrow at the fallback rate?

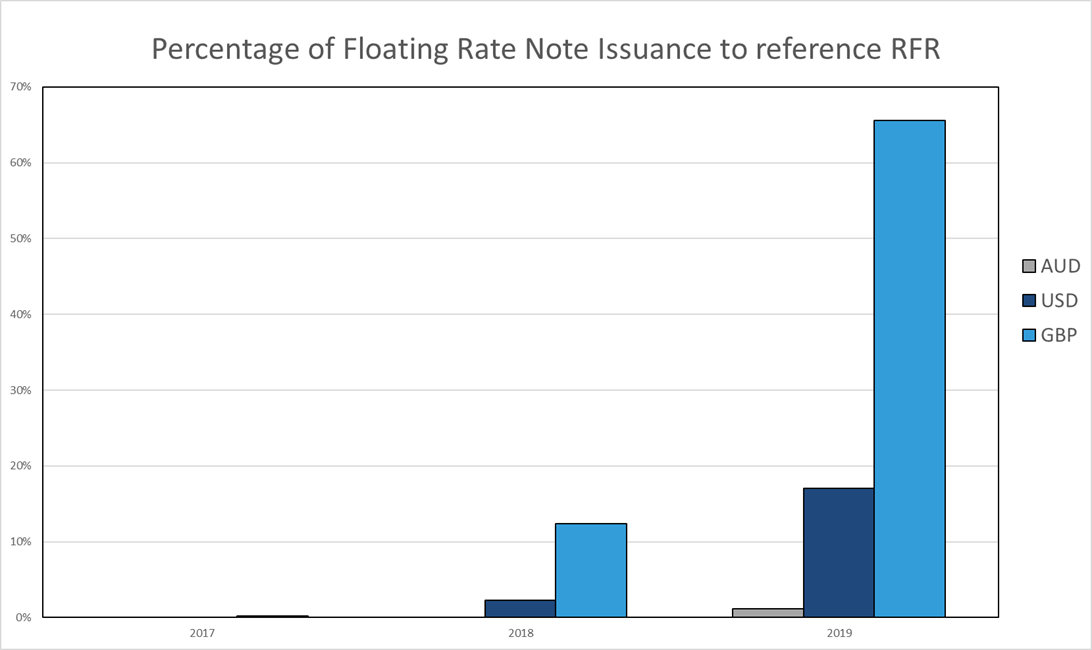

Possibly, and some large corporates in the UK (Associate British Ports and National Express) already have. In Australia, SAFA has issued floating rate notes at AONIA. Borrowing at the cash rate would certainly remove the problem of amending the document to allow for a fallback, however would require changes to documentation. The question should be can your systems accommodate a cash rate determined daily and compounding in arrears, and do you want to borrow on this basis? Budgeting for interest expense will be complicated, and while hedging with swaps should be easy, is this an exposure you want? The benefit, however, is that you don’t have to wait for the fallback to be invoked.

Next Steps?

- Consider these questions and how you might respond. Assess the impact of IBOR Fallbacks across your business (don’t just focus on borrowings and derivatives.)

- If your board and senior management are not across this issue, brief them now, preferably with information on your potential exposure.

- Start working on system changes to allow for the cash rate fallback.

- Contact all counterparties to any impacted document to negotiate the appropriate language. Ask your bank whether you can borrow at the cash rate. Watch out for an ISDA protocol.

- Bookmark the FTA resource centre in the Members section of the website, we’ll keep updating that section with information as it comes to hand. Keep an eye on adjustments to create term rates.

[1] For JPY the fallback is TONA, for ERIBOR the fallback is €STR and for CHF SARON

[2] AONIA is the Daily Reserve Bank of Australia Interbank Overnight Cash Rate