Trends in Technology & Treasury

Trends in Technology & Treasury

If a treasurer wants to be the go-to person for cash forecasting, financial planning, analysis and risk reporting, a modern TMS, efficient interfaces and best practice reporting will make the difference for efficiency, quality and timeliness of analysis.

Enterprise Integration, Business Intelligence and Big Data

Across all industries and professions, technological advances have made business and market data increasingly available to support strategic decision making. Corporate treasurers, armed with fit for purpose tools, have an opportunity to play a key role in data analysis to better manage liquidity and financial risks, in addition to supporting business partnering activities such as pricing and M&A.

Middleware Technology helps with the extraction and aggregation of granular datasets stored in enterprise systems and can deliver them to your TMS to generate tailored reporting dashboards. Key treasury metrics can be monitored and made available quickly and in user friendly formats for decision support. Examples include performance vs budget rates, hedging ratios, what-if scenario analysis and cash forecasts.

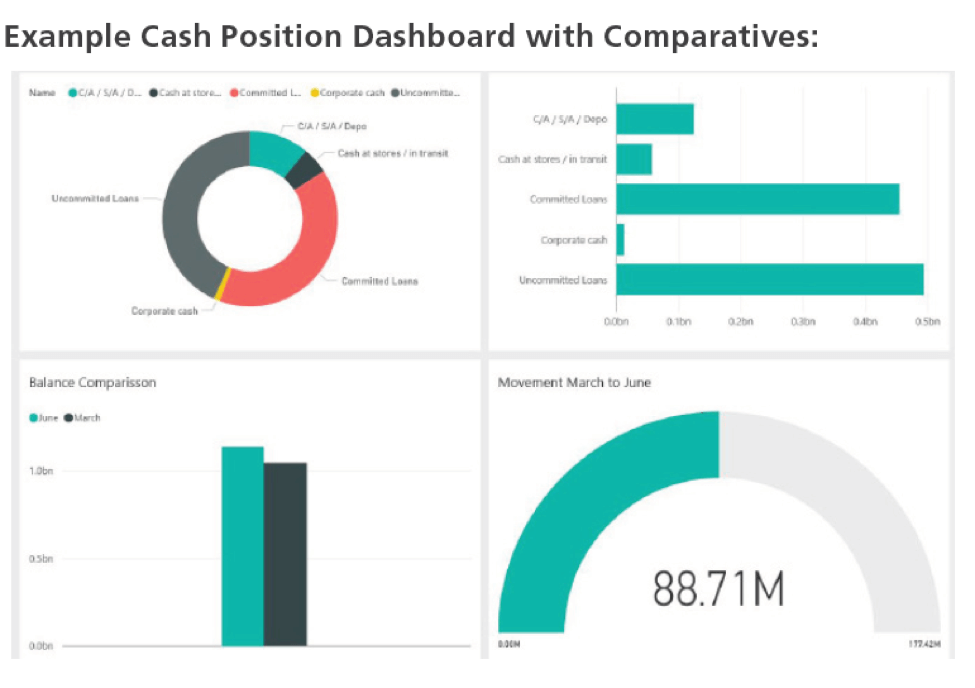

The diagram below shows an example of a corporate reporting dashboard for their cash position.

New data parsing and BI tools are also rapidly becoming a core part of enterprise wide reporting frameworks, whereby treasury data is consumed alongside other functions’ data by the CFO, the FP&A team and other stakeholders. By providing a single location to view critical metrics they offer excellent opportunities for sharing information across the organisation. This is a requirement that is simply not served by Excel in a robust and scalable way, and many companies are developing capabilities with such platforms. The key for TMS providers is to make their calculated core data available directly to users via a data warehouse solution.

This diagram shows how data flows in to and out of a data warehouse in the form of raw data in and reports out to multiple platforms which is the standard for the new BI tools.

Straight through processing

What can be automated, will be automated. With the technology focus on workflow and multi-platform availability, the scope for true straight through processing (STP) is increasing. STP can improve efficiency, processes, controls and reduce scope for fraud and errors. The TMS has the ability to provide messaging and notification functionality, allowing the payments and approval processes to be much more streamlined. Automated emailing and alerts enables approvals and limits checking to be done with ease. Deals can then flow through automatically to risk reporting and GL output.

Interfaces to external dealing and payments systems is another aspect of STP. In an ideal world, a treasury dealer will look at their risk position in the TMS and action a deal. The TMS can check dealing limits and any other restrictions and if everything is okay, the TMS will send a request for an FX or other deal type to an external dealing platform for transacting. Once the deal has been transacted, the TMS can load the confirmation and the payment advice will be automatically generated. Following approval, the deal can be automatically loaded to the payments platform for settlement. Deal intervention is only required when actioning, confirming and approving the deal, the rest flows automatically via STP.

The Cloud

No technology article is complete without mentioning the cloud. Deploying applications in the cloud can enhance security and allow the above workflows to happen more efficiently. Users don’t need to be in the office to approve deals or to view a risk report, business units don’t need to send forecast spreadsheets through to treasury for collation. Access to the most recent available business and markets data will lead to better and timely decision making and a more successful treasury can drive it all.

The combination of new software tools, advanced interfaces between applications and cloud computing can lead to a higher level of automation, real time reporting and better workflows. All of these technologies can be harnessed by a treasurer using a modern TMS as the analytical engine to drive the treasury function forward.

These developments represent an opportunity for treasury to have greater access to internal and external data, and increases the profile of treasury within the firm, setting the groundwork for a more successful treasury function.